The demand for accounting software with bank reconciliation stems from a crucial necessity: ensuring the accuracy of businesses’ financial records and preventing bank discrepancies. These discrepancies are prevalent across businesses of all sizes, leading to a range of issues, including:

- Financial Stability: Discrepancies distort cash positions, impacting financial reporting and investor confidence.

- Cash Flow Management: Mismanagement due to inaccuracies can delay payments and harm relationships.

- Compliance Risks: Errors can lead to penalties, audits, and legal complications.

- Trust Erosion: Stakeholder trust diminishes, impacting loans, investments, and relationships.

- Operational Inefficiency: Employee time spent resolving discrepancies leads to inefficiencies.

- Missed Opportunities: Misjudgment of resources and investments hinders growth.

- Internal Conflicts: Discrepancies can cause internal disputes, hampering teamwork.

The solution lies in streamlining bank statement importation through the adoption of accounting software that integrates bank reconciliation. In this post, we will review the top 5 accounting software options for bank reconciliation, starting with our personal favorite, Sage Business Cloud Accounting.

1. Sage Business Cloud Accounting

In a survey conducted by BlackLine, it was revealed that over half of global executives lack confidence in identifying financial data inaccuracies before reporting. Astonishingly, nearly 70% of business leaders and finance professionals admitted that their organizations have made significant business decisions based on inaccurate financial data. This alarming trend highlights the pressing need for robust solutions to enhance accuracy and reliability in financial reporting.

Sage Business Cloud accounting software streamlines bank reconciliation by making it easier for businesses to connect accounts, import bank transactions, and record debits and credits like charges, interest earned, and interest paid. These features are discussed in more detail below.

Automated Bank Reconciliation

The first feature we need to highlight is the automated bank reconciliation. Automation takes manual effort out of the equation and ensures a seamless alignment between internal financial records and bank statements. More importantly, it is an effective way to improve efficiency and productivity. In fact, business process automation is shown to generate up to 87% productivity increase for companies.

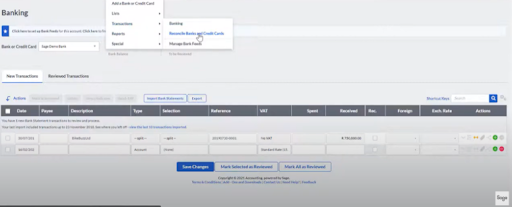

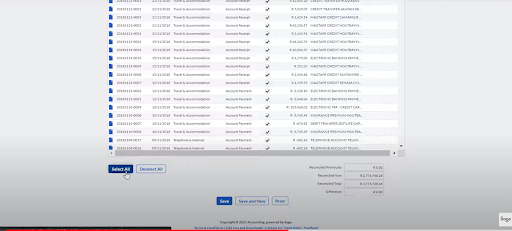

To reconcile your books to bank statements, head to the dedicated “Bank Reconciliation” section. The software takes charge of importing and matching transactions automatically. You simply need to select the transactions you want to reconcile.

As you review the reconciliation summary, you’ll find that the ending balance is automatically aligned with your bank statement. If any discrepancies arise, the system will handle the recording of unmatched transactions.

Quick Entry Rules

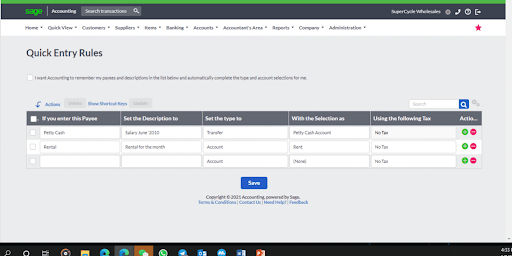

The feature allows for the customization of automatic transaction details for specific payees, eliminating the need to manually input the same information repeatedly. For instance, after establishing a quick entry rule for payee A, subsequent transactions involving payee A will seamlessly incorporate the predefined description and account selection. This not only reduces the risk of errors but also accelerates the entire data input process.

Users can easily define rules based on their unique business requirements. Once these rules are established, users experience a notable time-saving benefit. As transactions are processed, the software applies the quick entry rules and ensures that relevant details are automatically filled in .

Bank Statement Mapping Rules

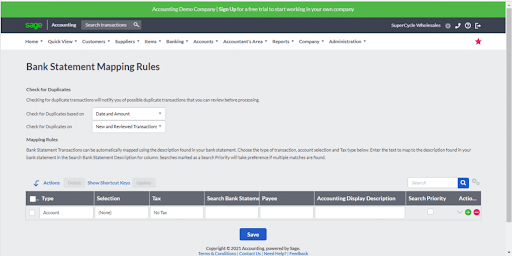

Bank Statement Mapping Rules in Sage Cloud Accounting simplify bank reconciliation by automating the categorization and matching of transactions. Users can define rules based on criteria such as keywords, amounts, or transaction types, allowing the software to automatically assign categories to imported transactions.

By swiftly categorizing and matching transactions based on predefined criteria, you save time and mitigate the risk of errors. The mapping rules also include features for exception handling, which enables you to address discrepancies that may require manual intervention.

2. Xero

Xero presents several notable advantages that help businesses with their bank reconciliation. Xero’s side-by-side layout for reconciling transactions is a practical feature. It streamlines the matching process and enhances user experience. The platform’s integration capabilities extend to over 700 apps, providing users with a wide range of options to tailor their accounting setup. Additionally, the Established plan introduces project management features, further expanding Xero’s utility for businesses.

Another standout feature is the inclusion of unlimited users across all plans. This helps promote collaborative financial management within a team. The availability of a mobile app facilitates convenient reconciliation of transactions directly from users’ devices, which adds flexibility to the accounting process.

With that being said, it’s essential to consider some limitations. Bank statements must be imported via a live connection or CSV file to perform a reconciliation, which may be a consideration for users who prefer alternative methods. Xero doesn’t support multicompany accounting, limiting its suitability for businesses with complex organizational structures.

3. QuickBooks

QuickBooks Online is another accounting software that is recognized for its robust bank reconciliation features. With automatic categorization and transaction matching, it significantly reduces the manual workload associated with reconciling accounts. The platform’s straightforward and user-friendly interface allows businesses to navigate their financial data seamlessly.

One of its best features lies in its seamless integration with bank feeds. This provides real-time updates and ensures that the latest transactions are readily available for reconciliation. This integration, combined with the platform’s automatic transaction matching, allows users to swiftly identify and reconcile discrepancies in their financial data.

It’s worth noting that while QuickBooks Online offers an accessible and intuitive experience, accessing certain advanced features may necessitate opting for higher-tier subscription plans.

4. ReconArt

ReconArt excels in universal account reconciliation and seamless integration with ERP systems and various platforms. It can handle high-volume transaction matching and features end-to-end automation. However, ReconArt may be cost-prohibitive for smaller businesses, lacks intuitiveness for end users, and does not offer a mobile app.

Overall, ReconArt offers advanced reconciliation capabilities but considerations should be made regarding cost, user-friendliness, and support limitations.

5. NCH Express Accounting Software

NCH Express Accounting Software is a cost-effective solution for small businesses. The software offers a compelling advantage for companies with five or fewer employees, providing free access indefinitely. It performs basic accounting tasks and extends its utility for larger companies through a one-time purchase fee. Optional add-ons for inventory and other functions enhance its flexibility, complementing an intuitive dashboard for easy navigation.

However, there are notable limitations. NCH Express Accounting Software lacks the ability to import bank transactions with a live connection, which limits real-time updates. The absence of a mobile app restricts accessibility, and the software is unable to capture and store receipt images.

Improve your bank reconciliation process and eliminate errors with Sage Business Cloud Accounting

Thanks to its user-friendly interface, automated bank feed, and wide range of customizability features, Sage Business Cloud Accounting stands out as the optimal choice for bank reconciliation.

Give your bank reconciliation process the boost it needs by transitioning to Sage Business Cloud Accounting. Pick the plan that suits your needs and start your 6 month free trial right away.